TRG | The Bottom Line – 8/4

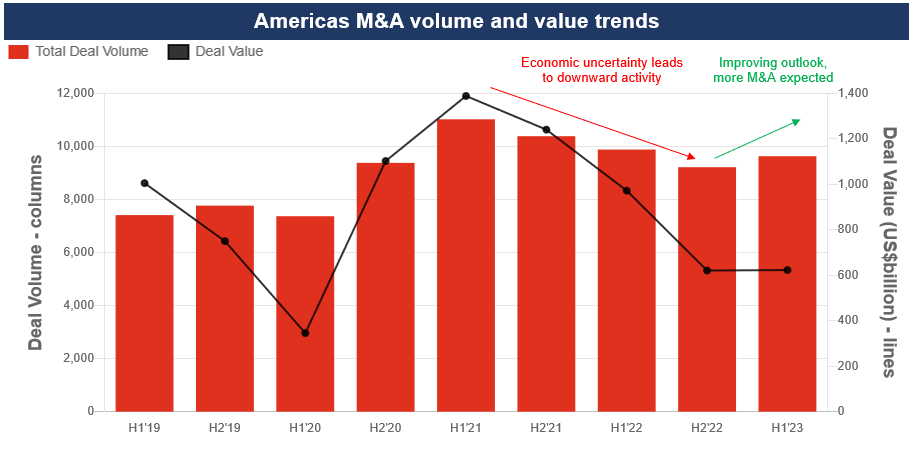

This week saw notable bolt-on acquisitions announced across our coverage universe. CRH announced the acquisition of Hydro International, which furthers CRH’s water and stormwater management offerings, and the fencing/railing/decking division of CertainTeed, which will contribute to CRH’s recent Barrette acquisition and flesh out the higher end offerings in the good/better/best suite of products offered. Ferguson (FERG) announced a basket of acquisitions across plumbing, waterworks, and HVAC adding 30 locations and ~$450MM in revenue, a standard process of FERG adding 1-3% growth from M&A. Other companies also executed bolt-on acquisitions throughout Q2, with Construction Partners (ROAD) acquiring a plant in an existing location and a greenfield in an adjacent market, Summit Materials (SUM) adding 2 pure play aggregates in existing markets and an integrated materials provider in a new market, Armstrong World (AWI) adding BOK Modern and bringing exterior products to AWI’s portfolio, Beacon Roofing (BECN) acquiring and opening greenfields at a rapid pace, and APi Group (APG) returning to bolt-on M&A after digesting a transformative acquisition last year. We view these deals as a signal of the start of what we expect will be very busy M&A activity through the end of the year. Outlook across end markets is about as good as can get (resi improving since the start of the year, non-res seeing activity across manufacturing and mega projects, public activity seeing a multi-year runway of funding) and companies have greater clarity and comfort with spending on acquisitions.