TRG | The Bottom Line – 8/9

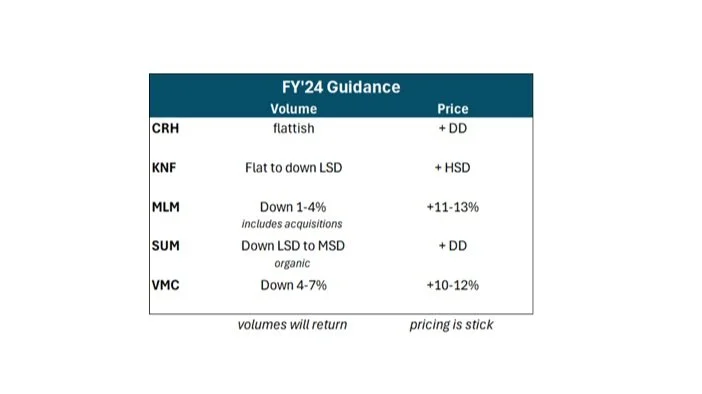

This week saw the majority of the heavy materials companies report earnings and we would note some similar themes as the group put up pretty sunny results considering the horrible weather that clouded much of the quarter. Most important in our view is that pricing guidance remains intact with expectations for LDD pricing the general consensus among companies. We viewed each company’s Q2 results as largely positive, with some raising FY guidance (CRH, KNF, ROAD), and some seeing margin growth despite volume challenges (MLM, SUM, VMC). Note that those who are less exposed to the weather impacted regions from Q2 were the ones to raise guidance, while the more weather region exposed companies still had solid performance across most metrics other than volume.

From an end market perspective state budgets remain solid with DOT’s still seeing plenty of runway for work, non-res remains better than headlines would indicate with heavy manufacturing / megaprojects / reshoring called out across most conference calls, while residential demand has been slower to come back than previously expected.

The outlook going forward remains solid, and any guidance revisions downward were more a function of running out of days in the year to catch up on volumes rather than a deterioration in demand. Volumes are not lost, just pushed out, and if guidance was for the NTM timeframe rather than a fixed FY’24 we expect most companies would feel as good about the outlook as before (we know TRG does!).